Note: The following radio button must be enabled from within your browser:

Before using the QuickBooks Online Link on a day-to-day basis, you must first perform some configuration steps and a first exchange. The Amicus QuickBooks Online Link Wizard guides you through this process.

|

Note: The following radio button must be enabled from within your browser:

|

● STEP 1 Connect to QuickBooks Online

● STEP 2: Customer Preferences

● STEP 3: Transaction Preferences

Before running the link wizard you may want to add service items and general ledger accounts in QBO for these transactions if they do not already exist:

● Billed Fees

● Expenses

● Retainer

● Tax 1 and Tax 2

● Write Off, if you intend to credit a single service item for write offs

● And optionally add the following general ledger accounts for Trust:

o Trust Liability

o Trust Check (if you intend to print

check in QuickBooks Online.

1. Log into QuickBooks.

2. Click the Gear icon at top of the screen to display the following menu:

icon at top of the screen to display the following menu:

● Please refer

to your QuickBooks Online help for information on how to add service items

and general ledger accounts.

3. Map all Amicus accounts to QuickBooks General Ledger accounts.

|

Note: You can map multiple Amicus accounts to the same QuickBooks account if you wish. |

● Click on a

menu item to display a list. Click New and fill

out the corresponding form in QuickBooks. Click Save

and close to complete the process.

The basic Amicus accounts are General Bank, Fees Revenue, and Expense.

If you've set the Link to exchange trust transactions, then two Trust

Bank categories are listed for each Trust Bank Account defined in Amicus:

a Trust Checks account and a Trust Receipts account. If taxes are enabled

in any Amicus files, then a Tax 1 Liability account (and a Tax 2 Liability

account if necessary) will be listed.

Amicus Accounts |

QuickBooks Accounts (suggested) |

General Bank |

Undeposited Funds (Asset) account. TIP: We recommend subsequently depositing funds to the appropriate General Bank account in QuickBooks. |

Fee |

Legal Fee Revenue account. |

Expense |

Typically, an Expense or Asset account. |

[Trust Bank Accounts] Trust Bank Accounts (as specified in your Options > Billing > Trust Accounts list), and only if you've configured the Link to exchange Trust transactions. For each Trust Bank Account specified in Amicus, two are provided for mapping: a Trust Check account and a Trust Receipt account. |

If you wish to use the Undeposited Funds (Asset) account, you should map Trust Checks and Trust Receipts to different QuickBooks accounts. TIP: If you wish to use a single account for both Trust Checks and Trust Receipts, consider mapping both Amicus accounts to a QuickBooks clearing (exchange) account. This enables a QuickBooks user to print checks and receipts against this clearing account, upon which the funds would be transferred as appropriate. |

Trust Liability Account GL Client Funds in Trust Only shown if you've configured the Link to exchange Trust transactions. |

Trust Liability Account |

Tax 1 Account GL |

A clearing (exchange) Liability account. |

Tax 2 Account GL Only if Tax 2 is applied by the firm for one or more non-closed, billable files. |

A clearing (exchange) Liability account. |

I. Character fields cannot be longer than 21 characters

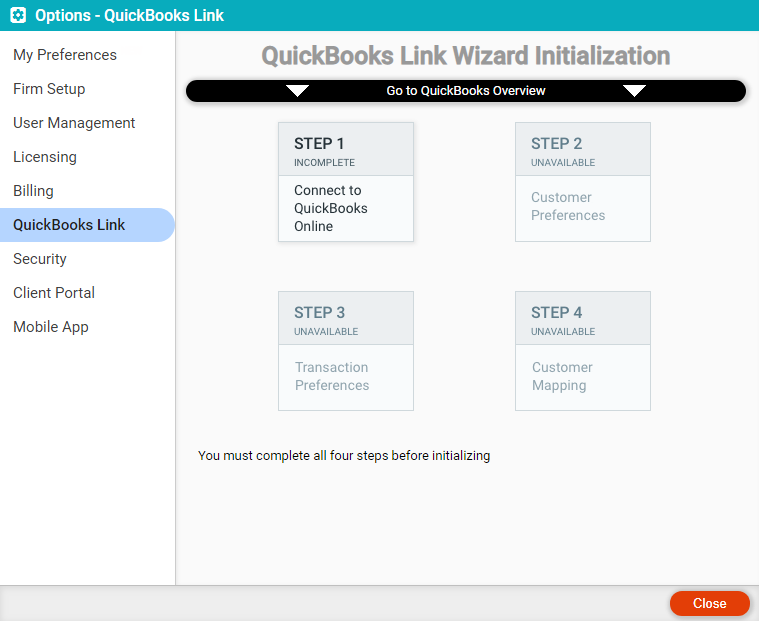

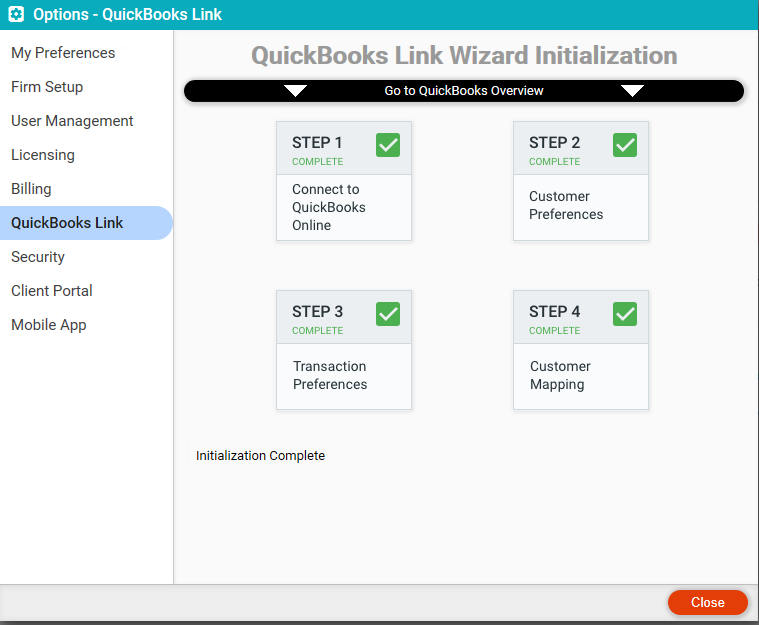

1. Choose Options > QuickBooks Link to display the QuickBooks Link Wizard Initialization window:

● Select the

Enable Amicus Cloud Integration with checkbox

to enable the QuickBooks Online option

2. Click the

Go to QuickBooks Link Wizard Initialization

bar to display the Go to QuickBooks Overview

wizard:

● Click the STEP buttons to start, resume, or redo the steps.

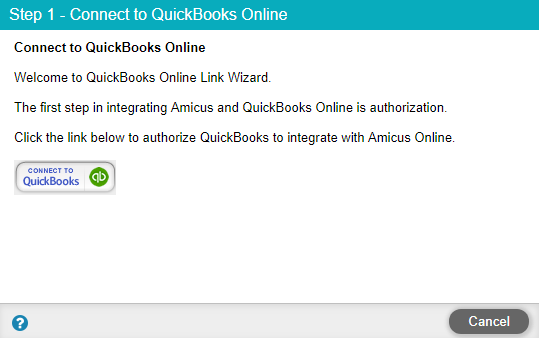

1. On the first

window that appears for STEP 1, click the Connect to QuickBooks button.

2. The following

window appears:

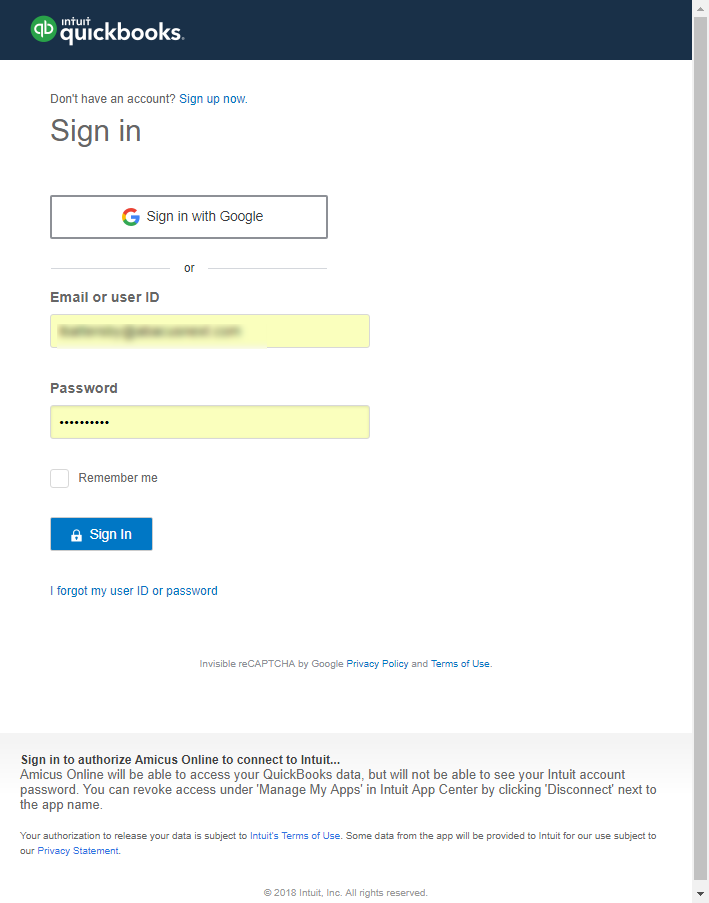

● Enter your

Intuit ID and Password

and click the Sign In button.

NOTE: You might not see this window if you are

already signed in to QuickBooks Online.

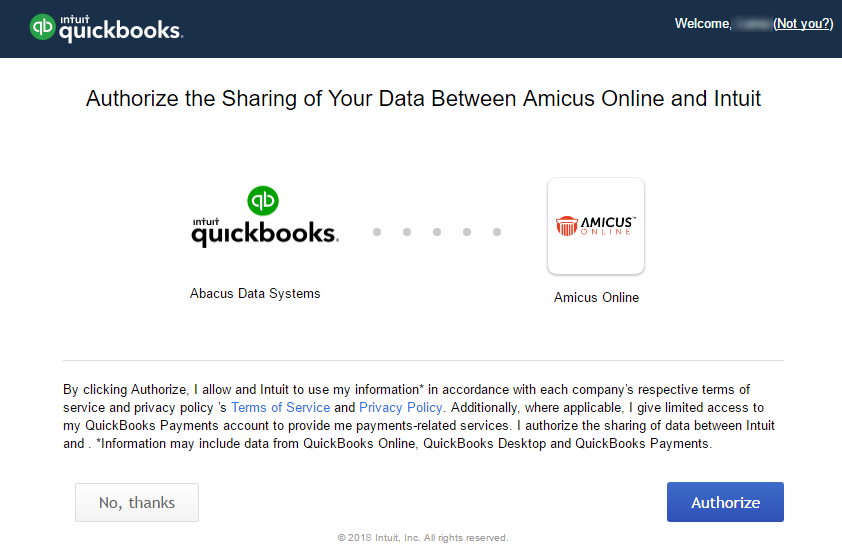

3. On the

next window that appears, click the Authorize

button to establish a connection.

4. You are returned

to the QuickBooks Link Wizard Initialization

screen. The message complete appears under STEP 1. You are ready to go to the next step in

the wizard.

Note: After connecting to QuickBooks

Online you can use this step (STEP 1) to disconnect the QuickBooks Online

Link.

|

Note: Conflicts are resolved based on the Link priority options set by Amicus Administrator. |

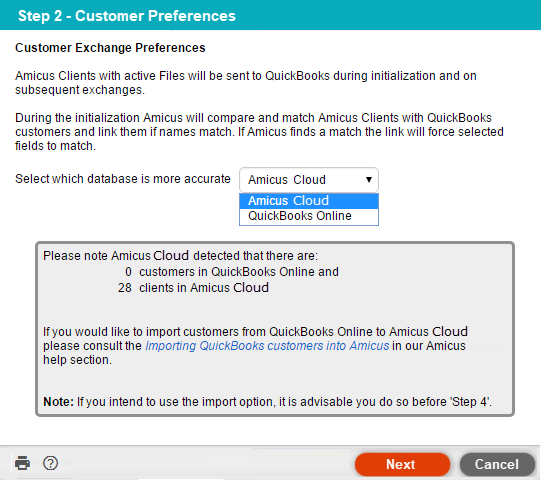

1. In the window

that appears for STEP 2, select which database

has more accurate client data (Amicus Cloud or QuickBooks Online) from

the dropdown menu to determine which program’s records will overwrite

the other in cases where matching records exist in both programs. This

affects initialization but not subsequent exchanges.

2. Click the Save & Close button and you are ready to go to the next step in the wizard.

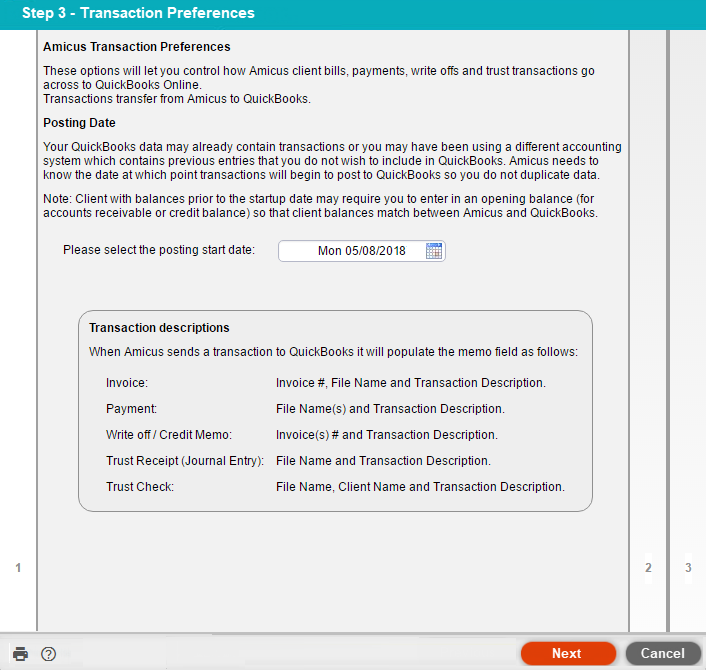

1. On the first

window that appears for STEP 3, choose a posting start

date from the Calendar control field for Amicus Invoice,

Payment, Write off/Credit

Memo, and (optionally) Trust transactions

to be exchanged to QuickBooks Online.

● Click the Next button.

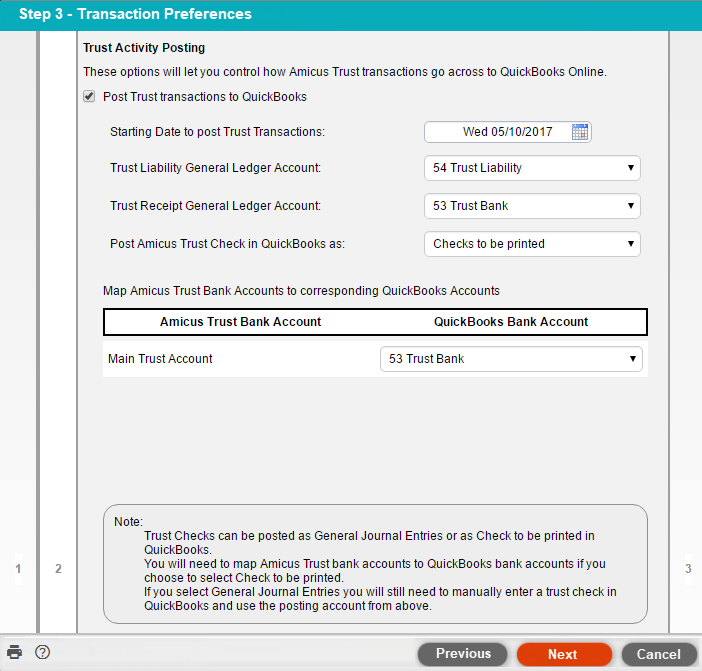

2. The next

window appears. If you do not want to post trust transactions to QuickBooks

Online, no changes need to be made to this window and you can click the

Next button. If you do want to post trust transactions

to QuickBooks Online, check the Post Trust transactions

to QuickBooks option, complete the remaining fields by selecting

items from the dropdown menus. Click the Next

button.

● Starting Date to post Trust Transactions: Only trust transactions for this date or later will be transferred to QuickBooks Online.

● Trust

Liability General Ledger Account: The General Ledger account (typically

a liability account with a credit balance) that holds the trust liability

balance.

NOTE: Changing this account after the QuickBooks

Online link has been established will not retroactively change entries

already posted.

● Post

Amicus Trust Check in QuickBooks as: Select either Checks

to be printed or General Journal Entry.

Selecting Checks to be printed displays all Amicus

Trust Bank Accounts where you can map Amicus Trust bank accounts to QuickBooks

Online bank accounts.

Selecting General Journal Entry displays the

QuickBooks Online chart of accounts. Selected trust checks create a general

journal entry with a debit against the QuickBooks Trust liability General

Ledger account and a credit to the selected General Ledger account. When

this option is selected, then you need to create a check manually in QuickBooks

Online and choose the selected General Ledger account.

3. On the next window, you can choose how items on bills are handled.

|

Note:

Write-offs are only handled for US QuickBooks Online customers. |

Transaction Mapping

Match Amicus Invoice items to a Service in QuickBooks

● Billed

Fees: Bills created in Amicus may have many fees and time entries.

When bills are posted in QuickBooks Online, Amicus invoices list one service

item for the combined total of the fees/time entries (net of discounts

or adjustments). The Billed Fees option lets you choose the single service

item to be used on invoices for fees/time entries.

NOTE: Each service item in QuickBooks Online

must be associated with a General Ledger account (typically an income

account). This ensures that when a client pays a bill that the proper

account is credited.

● Expenses: Bills created in Amicus may have many expenses. When bills are posted in QuickBooks Online, Amicus invoices list one service item for the combined total of the expenses. The Expenses option lets you choose the single service item to be used on invoices for expenses.

● Retainer: If a client makes an advance payment prior to being invoiced or makes an overpayment on a bill and it is deposited to the general bank account, then this is considered a retainer. The Retainer option lets you choose the QuickBooks service item for retainer.

● Tax 1, Tax 2: When bills are posted in QuickBooks Online, taxes appear as service line items on the bill. The Tax options let you choose the service items to be used on invoices for taxes.

Invoice Write offs:

● A write off

in Amicus creates a credit memo in QuickBooks Online to be applied to

the customer’s outstanding invoices.

For this option you can select Credit single service

item or Credit remaining outstanding items proportionally.

o If you select Credit single service item, a drop-down list appears where you can select a service item. When bills are written off, this service item is used to create a single line item for the amount of fees and expenses that are being written off (net of taxes).

o If you

select Credit remaining outstanding items proportionally,

the amount of the write off for fees and expenses (net of taxes) is determined

in proportion of the amount of fees and expenses on the original invoice.

Canadian QuickBooks Online Users

Transaction Mapping

Match Amicus invoice items to a Service and Tax in QuickBooks

● Billed

Fees: Bills created in Amicus may have many fees and time entries.

When bills are posted in QuickBooks Online, Amicus invoices list one service

item for the combined total of the fees/time entries (net of discounts

or adjustments). The Billed Fees option lets you choose the single service

item to be used on invoices for fees/time entries.

NOTE: Each service item in QuickBooks Online

must be associated with a General Ledger account (typically an income

account). This ensures that when a client pays a bill that the proper

account is credited.

● Expenses: Bills created in Amicus may have many expenses. When bills are posted in QuickBooks Online, Amicus invoices list one service item for the combined total of the expenses. The Expenses option lets you choose the single service item to be used on invoices for expenses.

● Retainer: If a client makes an advance payment prior to being invoiced or makes an overpayment on a bill and it is deposited to the general bank account, then this is considered a retainer. The Retainer option lets you choose the QuickBooks service item for retainer.

QuickBooks Tax Rates for:

Optionally, select a Tax Rate created in QuickBooks

Online from the dropdown list in the appropriate field.

o The dropdown lists default to "Select QuickBooks Tax Rate".

Invoice Write offs

● Write-offs in Amicus Cloud are not exchanged with QuickBooks Online. The write-offs must be performed in both applications.

4. Click the Finish button and you are ready to go to the next step in the wizard.

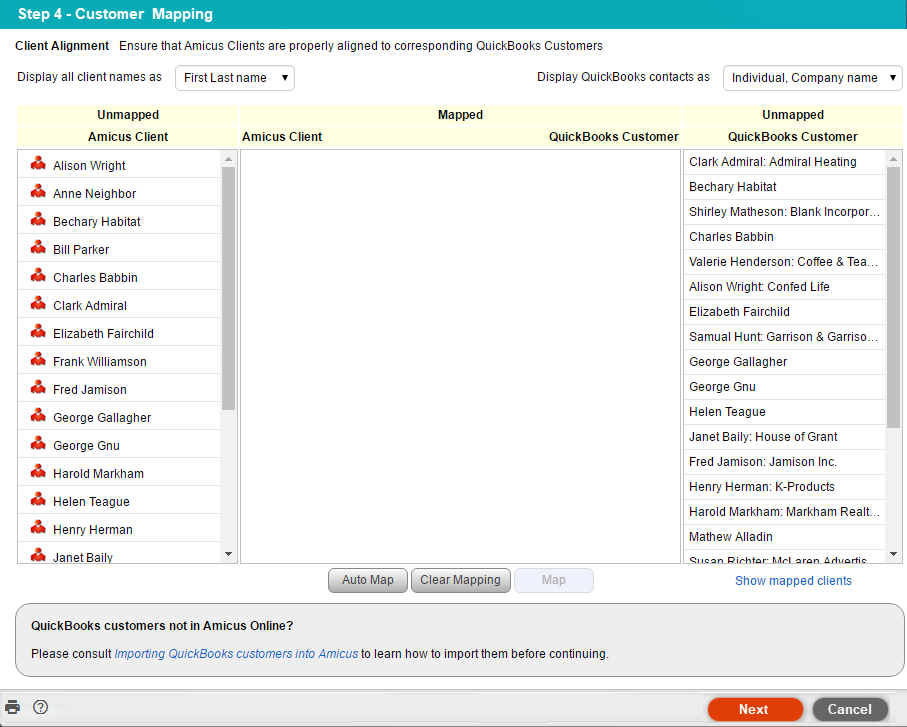

The Customer Mapping window lets you map Amicus Clients to QuickBooks Online customers.

1. Click the Auto Map button. The system maps the unmapped records where it is possible. The names must be exactly the same.

● Clients/Customer records in:

o Grey have been matched and mapped.

o Bold indicates that no match was found in QuickBooks Online.

o Red indicates

matching problems (for example, multiple corresponding matches in QuickBooks

Online).

● Hover over a Client/Customer record for more information about the conflict.

2. Map remaining unmapped records and conflicts manually. Highlight an unmapped record and then highlight a corresponding record and click the Map button (or Unmap button as appropriate).

3. Click the Save & Close button and you are ready to initialize the link.

1. Once the

four steps are completed, the Initialization Complete

option is active. Click this option.

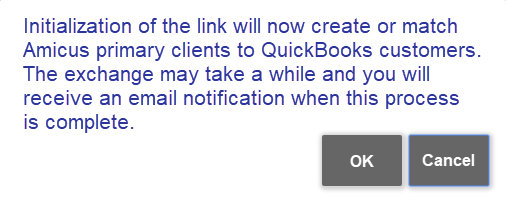

2. The following

message appears. Click OK to complete the initialization

process.

● The initialization process can take some time. You can continue your work in Amicus Cloud as you wish.

● To check your initialization status, click the Status button.

● When the initialization process is complete, a notification message appears in the window. If the process failed, a link providing the option to retry initialization appears.

● QuickBooks Online Link - What is it?

● QuickBooks OnlineLink - How to use it

● QuickBooks OnlineLink - What does it exchange?

● Importing QuickBooks customers into Amicus

Amicus Cloud (January 2023)

Copyright